39+ Bonus Tax California Calculator

Your employer will withhold tax from your bonus plus your regular earnings according to your W-4 answers. Qualifying surviving spouseRDP with dependent child.

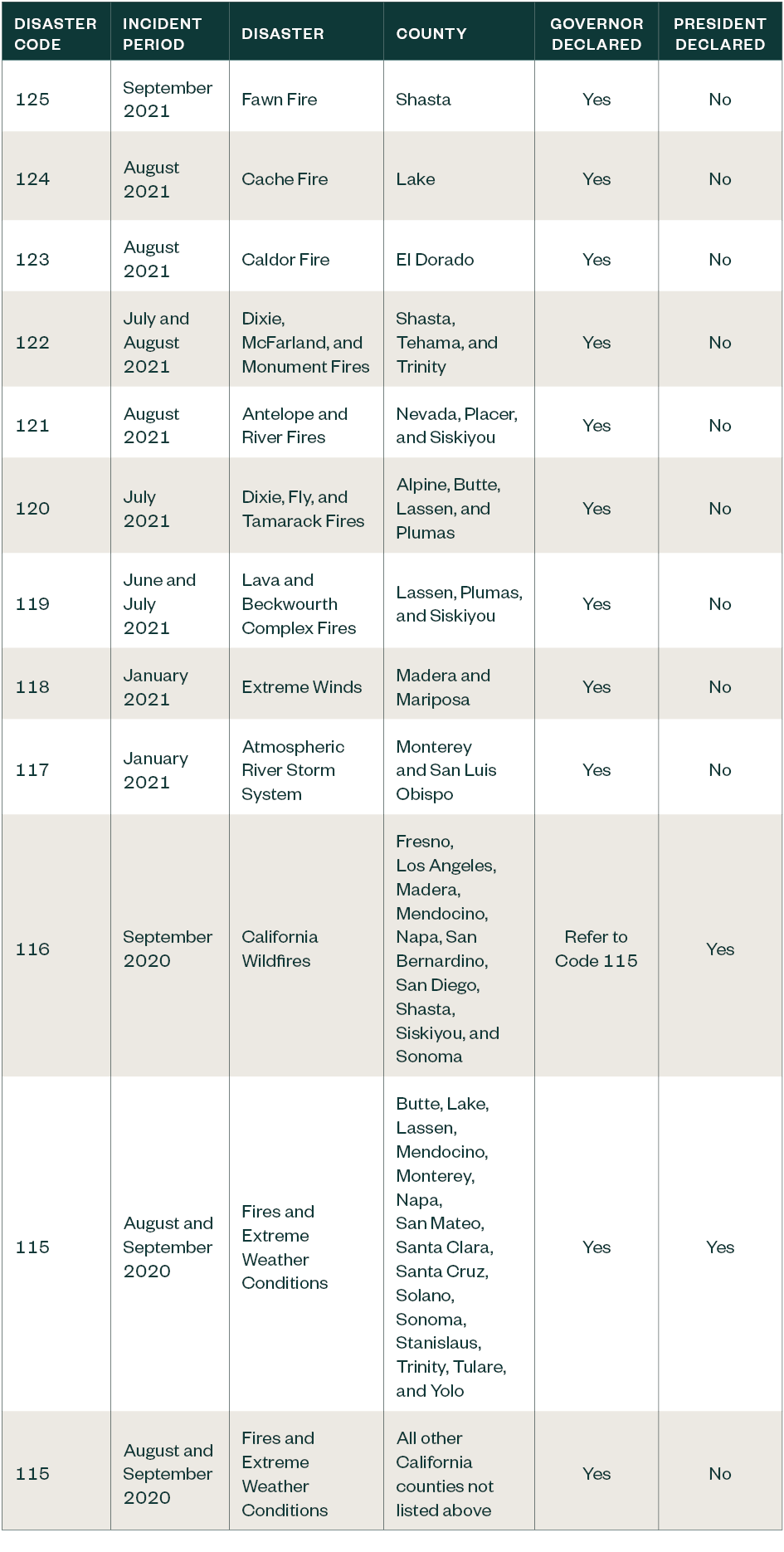

Tax Season 2021 California Developments And Opportunities

Bonuses are considered supplemental wages.

. Web California Paycheck Calculator For Salary Hourly Payment 2023 Curious to know how much taxes and other deductions will reduce your paycheck. Tax calculator is for 2022 tax year only. Web Use ADPs California Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Your bonus will be taxed the same as your regular pay. Web California Income Tax Calculator - SmartAsset 22108 - 34892 34893 - 48435 61215 - 312686 375222 - 625369 The city of San Francisco levies a gross receipts tax on the payroll expenses of large businesses. Web Calculate your California net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free California paycheck calculator.

Web Use our income tax calculator to find out what your take home pay will be in California for the tax year. Intelligent user-friendly solutions to the never-ending realm of what-if scenarios. Web The bonus tax rate is 22 for bonuses under 1 million.

Web This bonus tax calculator determines the amount of withholding on bonuses and other special wage payouts. Ad Use The Tax Calculator To Estimate Your Tax Refund Or The Amount You May Owe The IRS. The calculator on this page uses the percentage method which calculates tax withholding based on the IRSs flat 22 tax rate on bonuses.

Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is your take-home pay and Calculation Based On is the information entered into the calculator. Just enter the wages tax withholdings and other information required below and our tool will take care of the rest. Web The results are broken up into three sections.

Web Gross Earnings Wages salary commissions bonuses vacation pay or anything an employer pays an employee for personal services. Use the Free Paycheck Calculators for any gross-to-net calculation need. The payroll tax modeling calculators include federal state and local taxes and benefits.

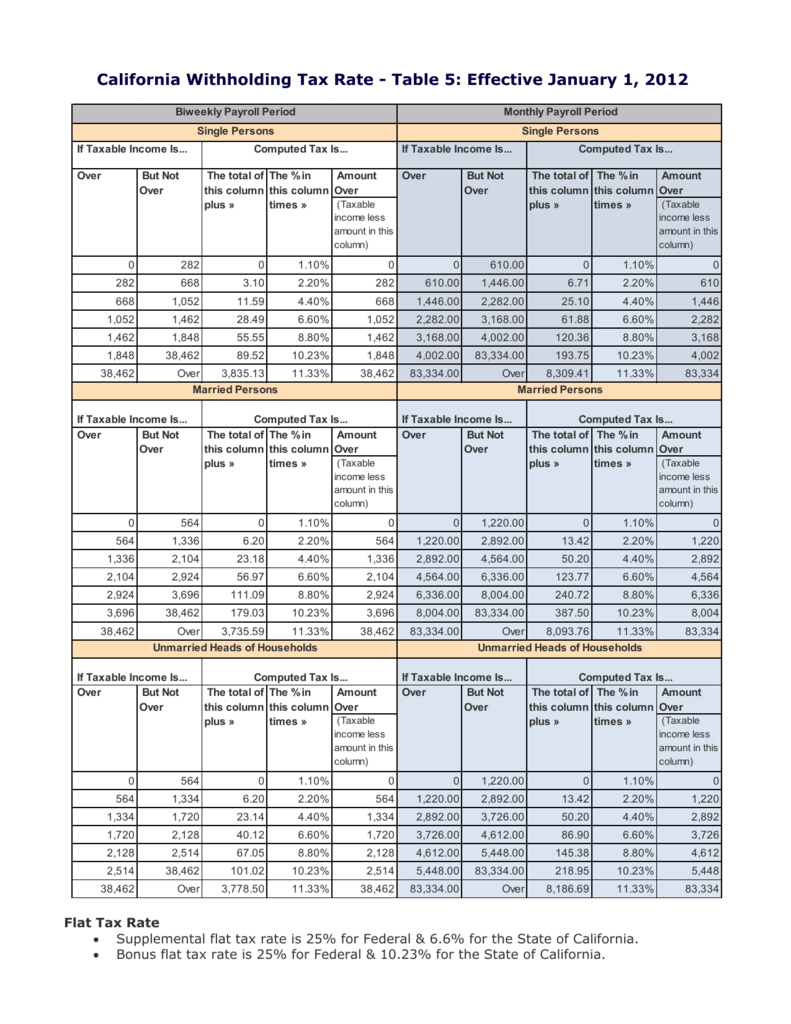

If your state does not have a special supplemental rate you will be forwarded to the aggregate bonus calculator. Employers can use one of two methods to withhold taxes on a bonus. Web The state income tax rate in California is progressive and ranges from 1 to 123 while federal income tax rates range from 10 to 37 depending on your income.

Tax brackets and rates depend on taxable income tax-filing status and state residency. Estimate Your Taxes And Refunds Easily With This Free Tax Calculator From AARP. How to Use This Bonus Tax Calculator To use this bonus tax calculator simply input the bonus amount and the tax filing status.

Web In California bonuses are taxed at a rate of 1023. Web Head of household. Get Deals and Low Prices On turbo tax online At Amazon.

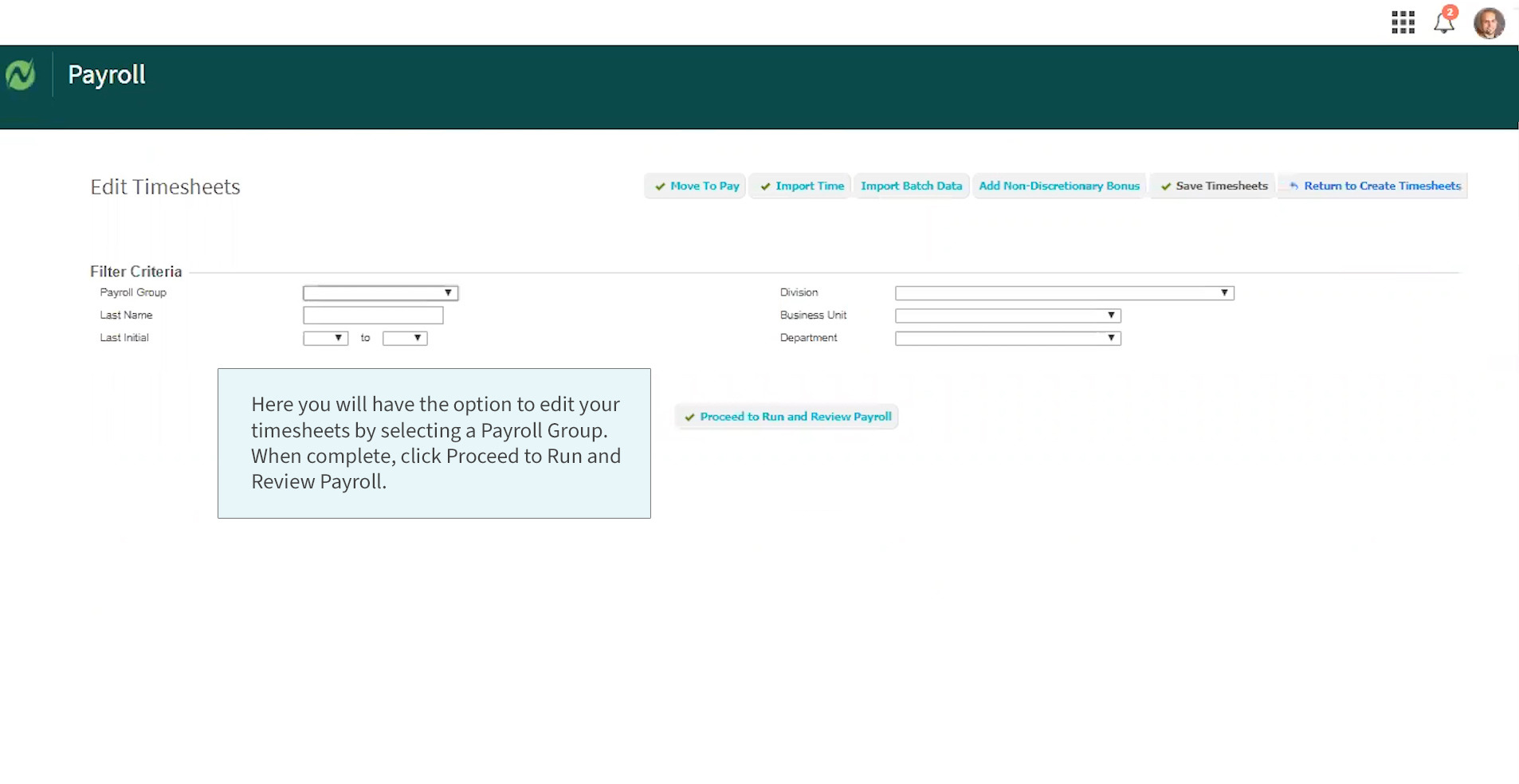

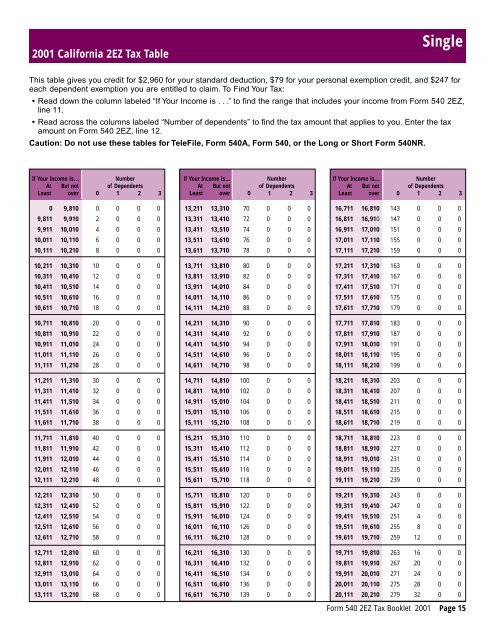

Enter your info to see your take home pay. Use the 540 2EZ Tax Tables on the Tax. Web The aggregate method is used if your bonus is on the same check as your regular paycheck.

Use our paycheck tax calculator. Enter your details to estimate your salary after tax. Web There are two ways to calculate taxes on bonuses.

California taxable income Enter line 19 of 2022 Form 540 or Form 540NR. Web This federal bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses. Web SmartAssets California paycheck calculator shows your hourly and salary income after federal state and local taxes.

Web To calculate the taxes due on a bonus check in California employers must first determine the amount of supplemental wages paid out during the tax year. 1 2 4 6 8 93 103 113 and 123. Although this is sometimes.

This calculator does not figure tax for Form 540 2EZ. It automatically calculates key information based on the state your employee resides in and allows you to input additional details necessary to calculate. They then multiply this number by 22 for federal income tax 1023 for California state income.

Web There are nine California state income tax brackets. The percentage method and the aggregate method. Web Use the California bonus tax calculator to determine how much tax will be withheld from your bonus payment using the aggregate method.

Quickly figure your 2022 tax by entering your filing status and income. Do not use the calculator for 540 2EZ or prior tax years. This paycheck calculator can help estimate your take home pay and your average.

In some cases bonus income is subject to additional taxes including social. Ad We Offer a Variety Of Software Related To Various Fields At Great Prices. Web Our paycheck calculator estimates employees California take-home pay based on their taxes and withholdings.

Web Calculate your 2022 tax. For example if you earned a bonus in the amount of 5000 you would owe 51150 in taxes on that bonus to the state of California.

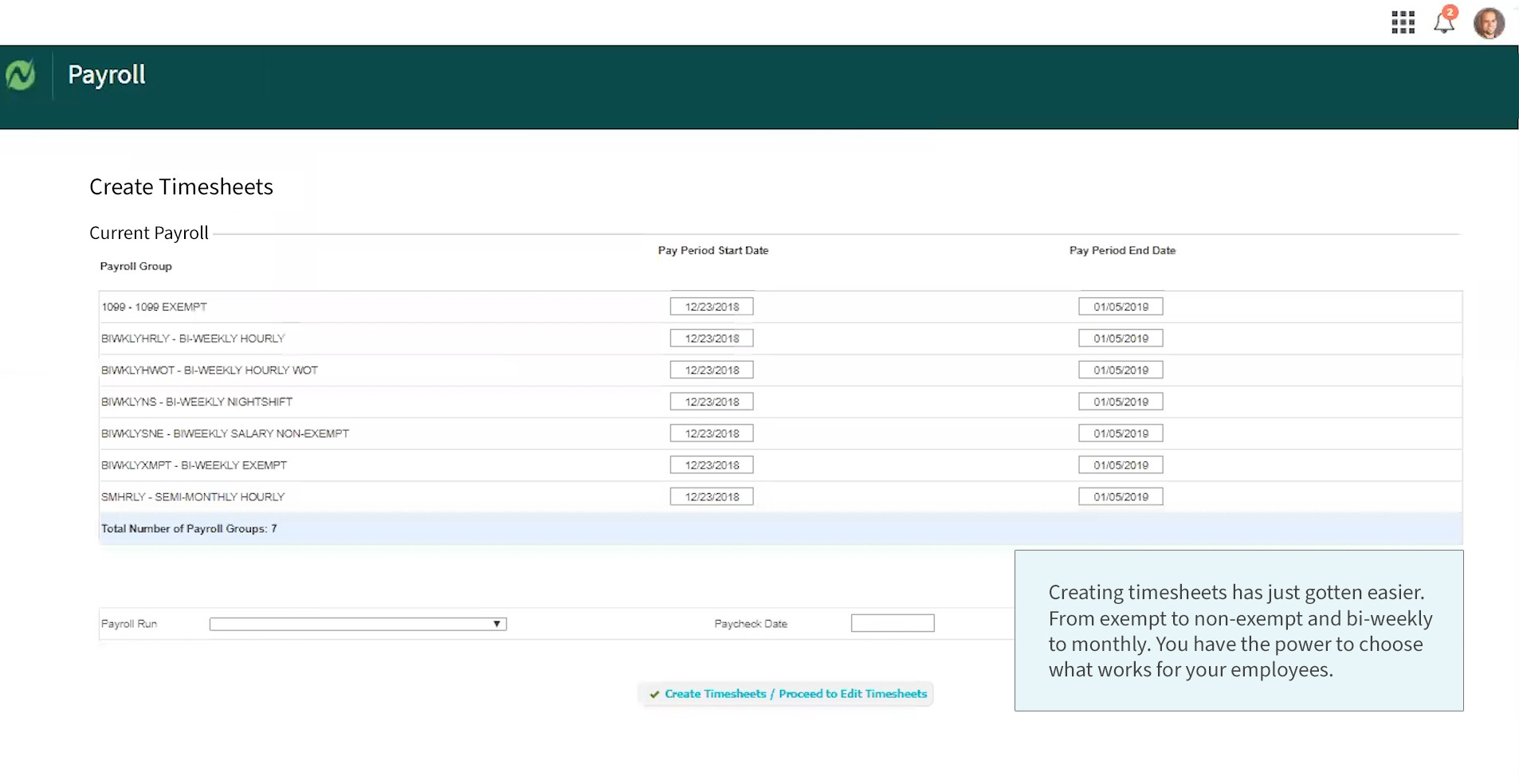

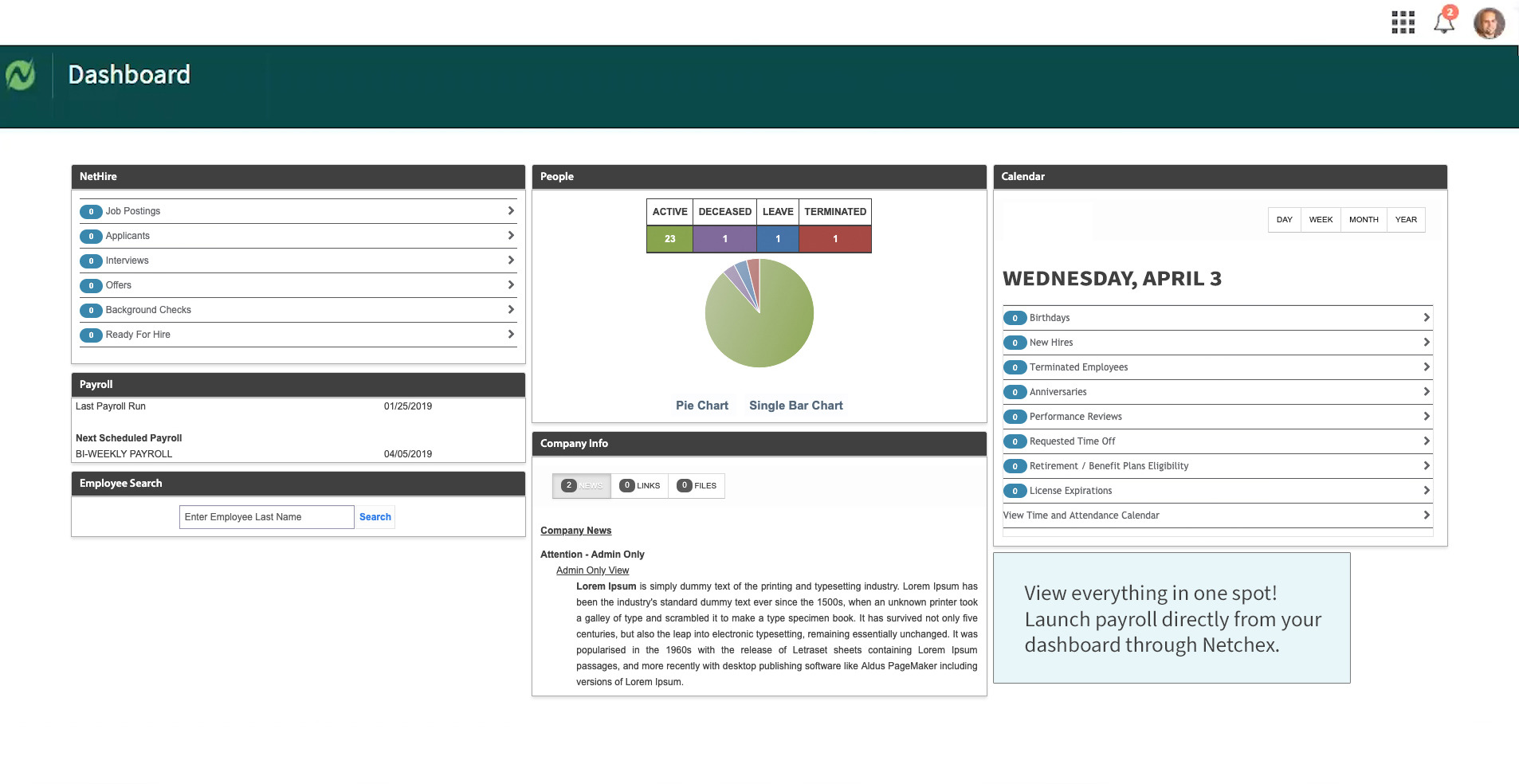

The Aggregate Bonus Calculator Netchex

Latitude 38 June 1990 By Latitude 38 Media Llc Issuu

How Bonuses Are Taxed Calculator The Turbotax Blog

Bonus Calculator Bonus Pay Tax Calculator Tool From Viventium

California Bonus Tax Calculator Percent Paycheckcity

The Aggregate Bonus Calculator Netchex

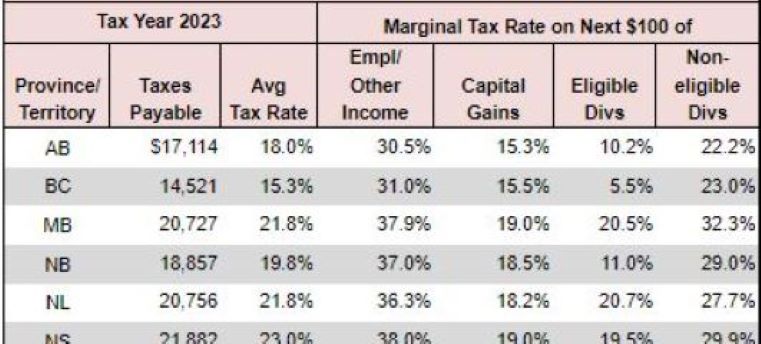

Taxtips Ca 2023 Earlier Basic Tax Calculator Compare 2 Scenarios

California Withholding Tax Rate Table 5 Effective January 1 2012

Bonus Calculator Bonus Pay Tax Calculator Tool From Viventium

California State Tax Calculator 2023 2024

November 2022 Saddle Up Magazine

California Ftb And Irs Estimated Tax Payments Abbo Tax Cpa San Diego Cpa

California Tax Calculator Taxes 2023 Nerd Counter

The Aggregate Bonus Calculator Netchex

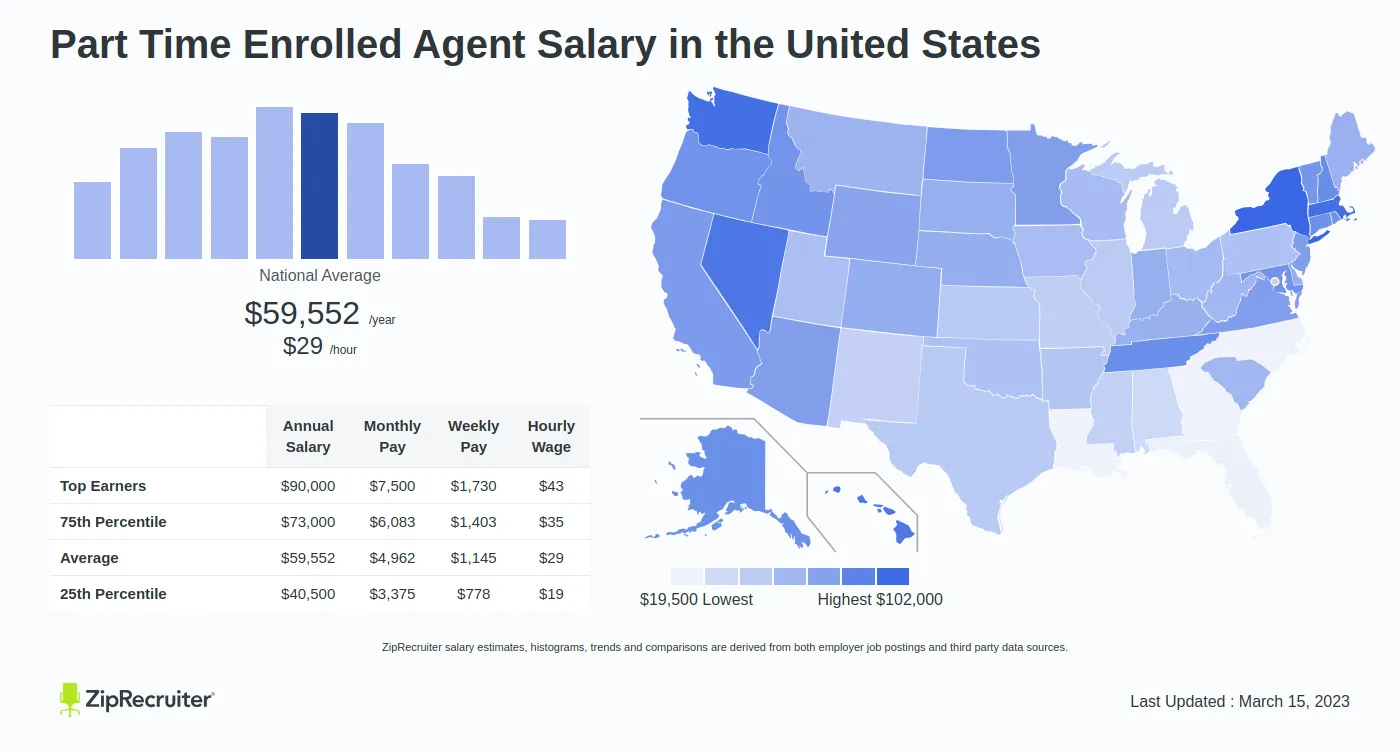

Salary Part Time Enrolled Agent Oct 2023 United States

2001 California Resident 540 2ez Tax Table

How Bonuses Are Taxed Calculator The Turbotax Blog